Well I did throw in the towel and give up the fight and I signed the Settlement Agreement. The fight was very costly not just in money but time and energy and I realized that one person cannot fight a huge corporation who I believe rather than pay claims uses the money from their client's policy payments to fight lawsuits. And their resources compared to mine are limitless.

As soon as I get the document signed back from them I will be in a much better place to comment about the situation at large.

I would never use Fidelity National Title Insurance Company to protect my real estate. A claim was filed with Fidelity for me by their Title Officer for the loss of a mile long easement to 80 acres with views of the famous Napa Valley in California. Fidelity valued the loss at $0 by a Boise Idaho appraiser. After suing Fidelity I was forced to settle for a fraction of the loss. I question whether Fidelity National Title Insurance Company acted in Good Faith in the handling of my claim.

Wednesday, December 19, 2012

Sunday, December 9, 2012

Fidelity National Title's Manager West Region

In July 2010 the Manager West Region honored by Reconsideration Request and the Fifth assigned Claims Counsel on July 22, 2010 considered the matter concluded and closed. But four days later the Manager West Region emailed "If you would like to provide us with an appraisal from a certified appraiser we would be more than willing to review it."

I spoke to different advisers who felt that this matter was still then open but that the actions of Fidelity National Title warranted other actions as the loss at this point was more than just the loss of actual easement but also the loss of the ability to market the property.

And one of the things also that had made an impression on me by this time was that the job of the Claims Counsel was not to help me as the insured but rather to represent the bottom line and profitability of the company itself.

The Second Appraisal from the same Appraiser from Boise Idaho

I requested that a different appraiser be retained to do the next appraisal and also the data I provided be included in the analysis.

The Fourth Claims Counsel from Fidelity wrote:

The Fourth Claims Counsel from Fidelity wrote:

Needless to say on November 19, 2009 the Fourth Claims Counsel sent an almost identical appraisal which did not address that "extensive sales data" I had sent and it now indicated not surprisingly after reading the Brief cited before - the value of the loss was not zero.

And also not surprisingly I did respond and it could be easily interpreted that I did "complain" which prompted the following response from the Fourth Claims Counsel:

The Fourth Claims Counsel with Fidelity National Title Expresses His Intentions

I could not get the Third Claims Counsel to respond to me so I finally wrote to the California Department of Insurance for help and assistance.

On August 18, 2009 I heard from the Fourth Claims Counsel that he was replacing the Third Claims Counsel. We had a phone conversation and I explained what had happened and how I felt that valuing an existing prescriptive easement to a road in a different county was inappropriate. And as naive as I was - I thought he actually understood and agreed with me.

Then a couple of weeks ago I read this - and I realized what a fool I had been to actually trust the Fourth Claims Counsel to actually have my best interests at heart.

On August 18, 2009 I heard from the Fourth Claims Counsel that he was replacing the Third Claims Counsel. We had a phone conversation and I explained what had happened and how I felt that valuing an existing prescriptive easement to a road in a different county was inappropriate. And as naive as I was - I thought he actually understood and agreed with me.

Then a couple of weeks ago I read this - and I realized what a fool I had been to actually trust the Fourth Claims Counsel to actually have my best interests at heart.

Needless to say when I read the above brief I was - well - it is difficult to describe exactly how I felt.

But here is what I understand from the above:

- First, when the appraiser originally advised the Third Claims Counsel "If the estimated Cost to Cure is less than the difference of the "Before and After Value", the Cost to Cure is considered to be the appropriate measure of damages." To me this means that at the time of the first appraisal, the appraiser determined that the "Before and After Value" was greater.

- The reason it was decided to do a second appraisal was because of my complaint to the Department of Insurance and not because a replacement value for an easement in Napa Valley could be to a different road in a different county.

- Even though one would think because of #1 is logical the Fourth Claims Counsel already feels that the second appraisal "will likely be lower."

- It is already felt that I might "complain".

- And finally, even though the property was foreclosed on because it was not marketable without the lost easement - they will then raise the foreclosure as an issue.

And one of the really interesting things is that the Fourth Claims Counsel never mentions to me or in any of the communication which I read that he understood that the lost easement was actually valid. As a matter of fact the second appraisal is done as if it were still lost. Very confusing.

A Very Confusing Letter From Fidelity National Title's Third Claims Counsel

On July 10, 2009 I received this letter:

So until year's later I understood this letter I interpreted this letter to say that although the Parcels were excepted in Schedule B they were still treating this as a covered loss and they were using the value determined in the DIV appraisal prepared by the appraiser from Boise Idaho. I CERTAINLY DID NOT GET THAT THE EASEMENTS WERE VALID. And my attorney did not understand this letter as saying that the easements were valid. Only after reading the internal communication three years later did I get that the easements ran with the land. What a shock !!!!!

In fact I disagreed with the statement that the Parcels 2 through 5 were excepted from coverage by Schedule B. Per Part One of Schedule B, number 3 states that "easements, liens or encumbrances, or claims thereof which are not shown by the public records" are excepted from coverage. And I was provided the recorded documents by the title officer in Napa prior to the original purchase.

The Easement is Valid - But Fidelity National Title Never Told Me

So as I delved into the documents that Fidelity provided - the most shocking thing which I discovered was that because of the Third Claims Counsel's inquiry - it was determined a year after it was lost - that the easement might actually be valid.

In the Policy Payment Approval Report dated June 26, 2009:

And then by the time the property has proven to be unmarketable without the easement:

In the Policy Payment Approval Report dated June 26, 2009:

And then by the time the property has proven to be unmarketable without the easement:

So according to this - even though the loss of the easement for almost a year had affected the marketability of the property tremendously, the Third Claims Counsel appears to be preparing a defense that there was actually no loss and the property is as insured.

And on June 30, 2009 from a Fidelity employee to the Third Claims Counsel:

At this same time as we had dropped the price of the property dramatically without getting even the slightest offer, I allowed the property to be foreclosed on.

Fidelity National Title Accepts the Appraisal from PGP Valuation of Boise Idaho

By this time my agent and I had dropped the sale price on the property more than seven times, decreasing the sale price more than $750,000. The loss of the private entrance through residential property leaving only a legal entrance through a commercial winery, which included the manufacturing facility and tasting room, was the single largest deterrent in the sale of the property. Traffic and noise from the vineyard operation, commercial manufacturing of the wine, and the constant flow of tourists to the tasting room and for special events were major objections of all potential buyers.

May 1, 2009 the appraiser from Boise Idaho completes his appraisal determining that perfecting the prescriptive easement to Cavedale Road in Sonoma County can be substituted for perfecting the easement to Mount Veeder Road in Napa County and valued the "Cost to Cure" at $13,500.

I wrote a response of almost 30 pages correcting errors and misinformation in the appraisal and providing additional documentation and comparable properties demonstrating that the loss was in excess of the insurance policy amount of $650,000.

On June 15, 2009 the Third Claims Counsel from to the Sonoma County Manager of Fidelity National Title Company and another Fidelity employee, "I'll call Ann and advise her that I'm waiting for Mr. Gibson to provide a written response to his review of the information Ann submitted in an attempt to increase the loss amount indicated in his original DIV report. I really need to discuss options 1 & 2 with you because Ann is asking me if we have acted on either of these options." (Note Option #1 was regaining Parcels 2 -5 and Option #2 was obtaining another residential easement from Mount Veeder Road.)

This email prompted the first investigation (a year after the problem arose) of the validity of the easement described as Parcels 2, 3, 4 and 5.

In the meantime the appraiser from Boise Idaho did respond to my response to his appraisal with what I felt was even more false and misleading data.

May 1, 2009 the appraiser from Boise Idaho completes his appraisal determining that perfecting the prescriptive easement to Cavedale Road in Sonoma County can be substituted for perfecting the easement to Mount Veeder Road in Napa County and valued the "Cost to Cure" at $13,500.

I wrote a response of almost 30 pages correcting errors and misinformation in the appraisal and providing additional documentation and comparable properties demonstrating that the loss was in excess of the insurance policy amount of $650,000.

On June 15, 2009 the Third Claims Counsel from to the Sonoma County Manager of Fidelity National Title Company and another Fidelity employee, "I'll call Ann and advise her that I'm waiting for Mr. Gibson to provide a written response to his review of the information Ann submitted in an attempt to increase the loss amount indicated in his original DIV report. I really need to discuss options 1 & 2 with you because Ann is asking me if we have acted on either of these options." (Note Option #1 was regaining Parcels 2 -5 and Option #2 was obtaining another residential easement from Mount Veeder Road.)

This email prompted the first investigation (a year after the problem arose) of the validity of the easement described as Parcels 2, 3, 4 and 5.

In the meantime the appraiser from Boise Idaho did respond to my response to his appraisal with what I felt was even more false and misleading data.

Saturday, December 8, 2012

Third Claims Counsel in Omaha Nebraska- Now It is Getting Interesting

When I reached the Third Claims Counsel in Omaha Nebraska he said that he was swamped from the closing of the Chicago Office but he did ask for the names of local appraisers which I provided him with.

I was then told that an appraiser was chosen from Fidelity's list of "approved" appraisers. Here is an email to the supervisor of the Third Claims Counsel from Boise Idaho. He appears to be well qualified in providing Diminution in Value appraisals for title companies in a variety of states but not necessarily familiar with the Napa Valley.

I was then told that an appraiser was chosen from Fidelity's list of "approved" appraisers. Here is an email to the supervisor of the Third Claims Counsel from Boise Idaho. He appears to be well qualified in providing Diminution in Value appraisals for title companies in a variety of states but not necessarily familiar with the Napa Valley.

The appraiser from Boise Idaho appears to be very well versed in producing an appraisal that is the lesser amount which is the "appropriate measure of damages". My understanding of this is that it is his job as a specialist in DIV appraisals to advise the Claims Counsel in how to come up with an amount that pays the least to the insured as an "appropriate measure of damages." Or am I reading the following email incorrectly?

And he indicates (but has never listed nor defined) the "commercial" vineyards he has appraised. Nor does he explain what this has to do with valuing the loss of a residential easement.

Friday, December 7, 2012

The Second Claims Counsel with Fidelity National Title Insurance Company

So I am now with a Claims Counsel in Chicago. I do not quite understand this - I just receive a letter stating that I have a new office and counsel. It does not make sense to me to transfer the claim from Walnut Creek, California near the subject property in the Napa Valley to Chicago but.............what do I know?

A document on November 18, 2008 Initial Fact and Claims Analysis states, "However, since these easements were included as insured parcels in Schedule A, we have provided coverage to our insured."

On December 30, 2008, the second Claims Counsel in Chicago wrote, "I have completed my investigation of your claim of loss resulting from a secondary easement insured by the Policy of Insurance as Parcels 2 through 5 of Schedule A but which was, in fact, not owned by the seller and was therefore not properly conveyed to you at the time of your purchase of the property in question. Consequently coverage is appropriate as defined b the terms and conditions of CTLA Standard Coverage Policy of Title Insurance No. CAFNT0928-949-0003-0006211344-fntic-2004-01-0."

I never heard from Claims Counsel Number 2 again. He just seemed to fall off the face of the earth.

On January 26, 2009 I finally called the first Claims Counsel in Walnut Creek who told me that the Chicago Office had been closed and that I had been assigned to my third Claims Counsel in Omaha Nebraska.

A document on November 18, 2008 Initial Fact and Claims Analysis states, "However, since these easements were included as insured parcels in Schedule A, we have provided coverage to our insured."

On December 30, 2008, the second Claims Counsel in Chicago wrote, "I have completed my investigation of your claim of loss resulting from a secondary easement insured by the Policy of Insurance as Parcels 2 through 5 of Schedule A but which was, in fact, not owned by the seller and was therefore not properly conveyed to you at the time of your purchase of the property in question. Consequently coverage is appropriate as defined b the terms and conditions of CTLA Standard Coverage Policy of Title Insurance No. CAFNT0928-949-0003-0006211344-fntic-2004-01-0."

I never heard from Claims Counsel Number 2 again. He just seemed to fall off the face of the earth.

On January 26, 2009 I finally called the first Claims Counsel in Walnut Creek who told me that the Chicago Office had been closed and that I had been assigned to my third Claims Counsel in Omaha Nebraska.

The First Claims Counsel with Fidelity National Title Insurance Company

First, although I am identifying the Claims Counsel as being with Fidelity National Title Insurance Company - I am not totally certain if this is the correct of the three affiliated companies. I am now aware that there are multiple affiliated companies - the one company I have not been able to identify that one person that I have dealt with works for is Fidelity National Title Insurance Company.

At any rate I spoke was assigned to my first Claims Counsel in Walnut Creek, California on October 29, 2008. In our conversation it ended with he was going to research on getting the easements back and he wrote to the title officer who had discovered the error, "Since she's trying to sell the property, and needs the claim resolved first, (and we apparently have a long professional history with her) I'm going to be sure to keep this on, or near, the front burner."

Well, I do not think I stayed on his front burner for long as I never heard back from him on the claim. On November 13, 2008 I was re-assigned to a new Claims Counsel in Chicago, Illinois.

At any rate I spoke was assigned to my first Claims Counsel in Walnut Creek, California on October 29, 2008. In our conversation it ended with he was going to research on getting the easements back and he wrote to the title officer who had discovered the error, "Since she's trying to sell the property, and needs the claim resolved first, (and we apparently have a long professional history with her) I'm going to be sure to keep this on, or near, the front burner."

Well, I do not think I stayed on his front burner for long as I never heard back from him on the claim. On November 13, 2008 I was re-assigned to a new Claims Counsel in Chicago, Illinois.

Listing the Property for Sale

In May 2008 I listed the property for sale and contacted all of the adjacent property owners whose properties the easements crossed that I would be crossing their properties. (I had been working on other properties and had not even been to this property in three years until we started getting it ready to put on the market.)

When I contacted the owner of the first property for the access off Mt. Veeder Road the new owner of the property questioned my right to cross her property. I sent her the copy of my Prelim with the parcels listed and the descriptions I had received from the Fidelity National Title Company title officer prior to purchasing the property. She did meet me at the gate from Mt. Veeder and the two of us traversed the easement to the adjacent property. The road through her property passed her pond and vineyard but the home was not visible from the road.

She told me that it was her understanding that I did not have an easement and she was checking with her attorney and title officer. I did have the opportunity to show the easement to my real estate agent with the owner's permission but we had to access it from the interior property as the owner never gave me the gate code. Prior to her title officer confirming that we did not have an easement we had been marketing the property with the two deeded easements from Mt. Veeder Road - this easement through residential property and the other through the commercial/manufacturing property.

After her Title Officer stated that the easement was not valid I immediately contacted my Fidelity National Title escrow officer with the problem.

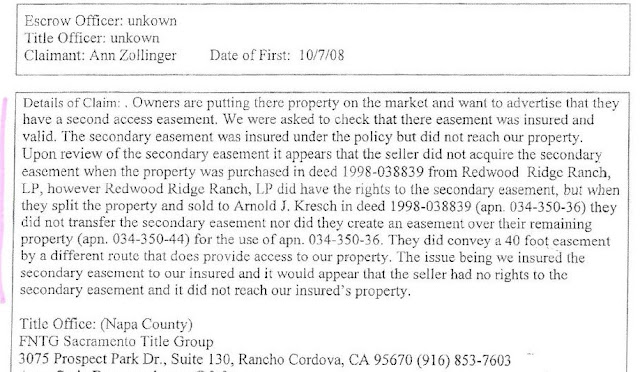

On October 9, 2008 a Fidelity National Title Company title officer wrote I believe to his boss, "We have asked to issue a pre that Fidelity has insured previously insuring appurtenant easements that do not reach our properties through adjacent properties. The good new is our property does have access by other means but not by the insured appurtenant easement. Our insured is now putting the property on the market and wants to advertise that she has and additional access (being the insured easement). I know we need to forward to the claims department, but escrow wants to know what she should advise her customer. I think we should be up front and let her know the facts and that it will be handled by the claims department. Please advise."

The addressee responded, "Your response is the correct one. You should inform the insured that the matter is being referred to claims counsel and that they will be hearing from claims counsel."

The following Confidential Claim Report to General Counsel was filed:

When I contacted the owner of the first property for the access off Mt. Veeder Road the new owner of the property questioned my right to cross her property. I sent her the copy of my Prelim with the parcels listed and the descriptions I had received from the Fidelity National Title Company title officer prior to purchasing the property. She did meet me at the gate from Mt. Veeder and the two of us traversed the easement to the adjacent property. The road through her property passed her pond and vineyard but the home was not visible from the road.

She told me that it was her understanding that I did not have an easement and she was checking with her attorney and title officer. I did have the opportunity to show the easement to my real estate agent with the owner's permission but we had to access it from the interior property as the owner never gave me the gate code. Prior to her title officer confirming that we did not have an easement we had been marketing the property with the two deeded easements from Mt. Veeder Road - this easement through residential property and the other through the commercial/manufacturing property.

After her Title Officer stated that the easement was not valid I immediately contacted my Fidelity National Title escrow officer with the problem.

On October 9, 2008 a Fidelity National Title Company title officer wrote I believe to his boss, "We have asked to issue a pre that Fidelity has insured previously insuring appurtenant easements that do not reach our properties through adjacent properties. The good new is our property does have access by other means but not by the insured appurtenant easement. Our insured is now putting the property on the market and wants to advertise that she has and additional access (being the insured easement). I know we need to forward to the claims department, but escrow wants to know what she should advise her customer. I think we should be up front and let her know the facts and that it will be handled by the claims department. Please advise."

The addressee responded, "Your response is the correct one. You should inform the insured that the matter is being referred to claims counsel and that they will be hearing from claims counsel."

The following Confidential Claim Report to General Counsel was filed:

Wednesday, December 5, 2012

Meeting with Fidelity National Title Officer in 2002

In 2002 I met with the Title Officer from Fidelity National Title Insurance Company who gave me the parcel map with the easements marked and copies of all of the public records for all of the easements meaning both easements from Mt. Veeder Road in Napa County to the property.

It was apparent to me after this meeting that I needed to deal with the opinion expressed by Fidelity in a previous Preliminary Title Report on the property of the view easement. But it was also my understanding that there were two easements from Mt. Veeder Road to the property and that there were public records for these easements.

It was apparent to me after this meeting that I needed to deal with the opinion expressed by Fidelity in a previous Preliminary Title Report on the property of the view easement. But it was also my understanding that there were two easements from Mt. Veeder Road to the property and that there were public records for these easements.

Fidelity National Title Company's First Mistake

In 1998 Hamilton Vose subdivided his property and sold this 80 acre parcel. At that time the Grant Deed from Napa Land Title Co. lists only Parcel One (the subject property) and Parcel Two (later in the Fidelity Grant Deed described as Parcel Six - the easement through the former Chateau Potelle property).

In 2002 and again in 2004, Fidelity National Title Company added Parcels Two, Three, Four and Five comprising the northern aka lost easement.

According to Fidelity's Website:

"In order to determine the

status of title, Fidelity National Title conducts a diligent search of the

public records for those documents associated with the property."

So one of the reasons I was told that the easement was not valid was because it was never the seller's to deed to me. Reading these two Grant Deeds last week - this actually made sense for the first time. Not being a title officer preparing a Preliminary Title Report and a Grant Deed on a property for a client, I would think that part of doing a "diligent search of the public records for those documents associated with the property" would include looking at the Grant Deed of the Seller !!!!!! Guess not.

Monday, December 3, 2012

Describing the Three Easements

As I spent days pouring over the documents from Fidelity National Title Insurance Company trying to find out what had actually happened - I occasionally got a glimmer of what was really going on behind the scenes. I am over the next few days going to chronicle what happened using the documents they provided and I will let you draw your own conclusions.

But first it is important to illustrate the three easements to the subject property:

But first it is important to illustrate the three easements to the subject property:

This map was prepared by a Fidelity Title Officer for Claims Counsel #3. I did add the color to make it easier to identify the three easements.

The green easement (which actually continues along the curved property line to Mt. Veeder Road in Napa County) is the only deeded easement at this time. It comes up through the former Chateau Potelle Winery including the facility for the manufacture of wine and the tasting room making this a commercial/manufacturing entrance to the property.

The pink (dotted) easement to Mt. Veeder Road in Napa County is the northern residential easement and is the easement that apparently should not have been included in the Grant Deed but still indeed may run with the land - I will explain this more later.

The short easement outlined in blue is the prescriptive easement to Cavedale Road in Sonoma County. This is the easement that PGP Valuation from Boise Idaho valued at $3500 to obtain as a substitute for the residential (pink) easement for the "Cost to Cure" valuation. His methodology was a square foot calculation (length X width) and then using that figure to his estimation of value per acre. Needless to say I felt this was not comparable as this easement a) I already had and was using, b) it is obviously much shorter, and c) it leads to a different road in a different county than the lost easement.

Sunday, December 2, 2012

"Public insurance companies are the only companies that improve their business by not providing a service to their customers."

"Public

insurance companies are the only companies that improve their business by not

providing a service to their customers."

I forgot to include this quote in the previous blog entry with the article by Luke Landes. I really like this quote a lot !!!!!!

He then makes this comparison:

I forgot to include this quote in the previous blog entry with the article by Luke Landes. I really like this quote a lot !!!!!!

He then makes this comparison:

"While everyone jokes about cable

companies, they provide customer service by making sure you’re getting hundreds

of channels all the time. They may not show up at your door to fix problems,

but there are hardly any problems. If a cable company categorically refused to

deliver service despite charging its customers every month, it would go out of

business; yet, this is exactly how public insurance companies must operate in

order to succeed."

He also explains the difference between a mutually held insurance company as opposed to a public insurance company - I after I finish this blog - the next item on my list is to begin researching all of the insurance companies that I use (primarily auto and health insurance) and find companies that do not have shareholders but are mutually held.

Insurance Companies Work for Shareholders, Not Customers

I just read a great article on the internet !!!!

Insurance Companies Work for Shareholders, Not Customers

Insurance Companies Work for Shareholders, Not Customers

This article was written by Luke Landes

Please read the entire article as I believe he makes some excellent points like:

"The entire concept of insurance,

particularly public insurance companies with shareholders, is backward. If a

company is to survive year after year, it has to make money for its owners. In

the case of public companies, executives answer to the board of directors and

the shareholders."

"Here is how insurance companies make

money, reduced to the absolute basics:

- Collect as much as possible from insured policyholders

in the form of premiums.

- Pay out as few claims as possible (but enough to avoid

regulatory scrutiny) to policyholders.

- Profit."

"When you battle with a

publicly-traded insurance company that doesn't want to pay your claim, it is

trying to earn another fraction of a cent per share. You just want the company

to honor your insurance agreement in exchange for the premiums you have been

paying."

This is exactly what I believe happened in my case with Fidelity National Title Insurance Company. I just wanted them to pay me for my loss that they confirmed was a valid claim - but then in order to protect the value of their shares for their shareholders - they valued the loss at $0.

Saturday, December 1, 2012

The Cloud on the Title Made My Property Unmarketable

One of the huge questions in this case was the actual value of the lost easement. Obviously Fidelity National Title with the assistance of their appraiser from PGP Valuation in Boise Idaho valued this loss at $0.

I, on the other hand, felt that my loss was approximately $800,000 and I felt passionately about this. And then I also felt that Fidelity had wasted thousands of hours of my time plus the legal fees and expenses in just beginning the lawsuit and then throw my attorney's compensation which was well deserved.

After having spent a full two days pouring over the thousands of pages Fidelity National Title had sent looking for examples of their having acted in Bad Faith - more on that later today - I was driving to the Settlement Conference in Walnut Creek. Somewhere on I-680 the lightbulb went off on why I felt so strongly about this.

It was not a mile long strip of dirt that I lost - what I lost was the ability to market and sell my property due to the cloud (error) in the title and Grant Deed prepared and insured by Fidelity National Title. I listed the property in May 2008 and we marketed it first with three easements and then with two easements with a disputed third until October 2008 and finally even in a letter in January 2009 my agent wrote that we still had one potential buyer waiting for resolution (and Claims Counsel #1 was going to pursue obtaining the easement again.)

In the meantime we were dropping the price of the property like a lead balloon in response to this cloud on the title that was proving to make the property unmarketable. By the time the title officer from Fidelity confirmed the loss of the easement we had already dropped the price by $400,000.

I, on the other hand, felt that my loss was approximately $800,000 and I felt passionately about this. And then I also felt that Fidelity had wasted thousands of hours of my time plus the legal fees and expenses in just beginning the lawsuit and then throw my attorney's compensation which was well deserved.

After having spent a full two days pouring over the thousands of pages Fidelity National Title had sent looking for examples of their having acted in Bad Faith - more on that later today - I was driving to the Settlement Conference in Walnut Creek. Somewhere on I-680 the lightbulb went off on why I felt so strongly about this.

It was not a mile long strip of dirt that I lost - what I lost was the ability to market and sell my property due to the cloud (error) in the title and Grant Deed prepared and insured by Fidelity National Title. I listed the property in May 2008 and we marketed it first with three easements and then with two easements with a disputed third until October 2008 and finally even in a letter in January 2009 my agent wrote that we still had one potential buyer waiting for resolution (and Claims Counsel #1 was going to pursue obtaining the easement again.)

In the meantime we were dropping the price of the property like a lead balloon in response to this cloud on the title that was proving to make the property unmarketable. By the time the title officer from Fidelity confirmed the loss of the easement we had already dropped the price by $400,000.

Price

reductions were as follows:

6/13/2008 $1,295,000 List Price

8/5/2008 $1,195,000

8/15/2008 $ 995,000

9/24/2008 $ 945,000

10/13/2008

$ 895,000

10/22/2008 $ 845,000

11/4/2008 $ 795,000

1/22/2009 $ 770,000

2/19/2009 $ 745,000

4/2/2009 $ 649,000

5/28/2009 Withdrawn/Cancelled

The

property was foreclosed on in July 28, 2009 when a negotiation for a purchase

price of $525,000 failed.

More later........................................

Subscribe to:

Posts (Atom)