As I continue to sort through documents from Fidelity National Title - I keep discovering the names of other Fidelity Employees that were some how aware and/or worked on my escrow, title, claim and/or lawsuit with the exception of William Foley - who I wrote a letter to - but so far he has not responded.

Whether or not to work with Fidelity National Title for your escrow and title needs and whether or not to insure your real estate with this company is obviously an individual decision. BUT with that said I would NEVER work with either Fidelity National Title Company nor Fidelity National Title Insurance Company nor any of the following individuals again. Nor would I use Jim Gibson or Philip Steffen for appraisal services.

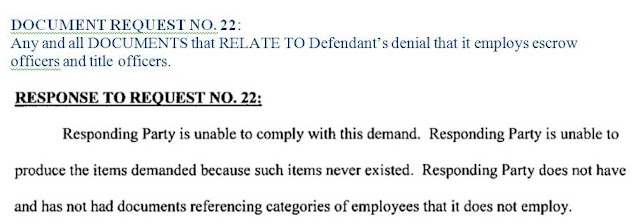

Lynn Rode, Fidelity National Title, Escrow Officer

Debbie Shelton, Fidelity National Title, Escrow Officer

Lee Grice, Fidelity National Title, Title Officer

John Hlivka, Fidelity National Title, County Manager

Craig Donner, Fidelity National Title, Title Officer

Paul Anin, Fidelity National Title

Douglas Borchert, Fidelity National Title

Dennis Lucey, Fidelity National Title, first Claims Counsel

Adam Pinchuck, Fidelity National Title, second Claims Counsel

Robert Q. Kelly, Fidelity National Title, third Claims Counsel

Owen Girard, Fidelity National Title, Claims

James Gibson, Appraiser, Boise Idaho

Philip Steffen, Appraiser, Phoenix Arizona

PGP Valuation Inc., Appraisal Company

Gary Colemere, Fidelity National Title, Title

Steven K. Johnson, Fidelity National Title Group, Quality Assurance Counsel

Colleen Babutzke, Fidelity National Title

Jeff Hansen, Fidelity National Title, fourth Claims Counsel

Todd Moody, Fidelity National Title

Jennifer Reeves, Fidelity National Title, fifth claims,West Coast Manager

Ryan Forrest, Fidelity National Title, sixth Claims Counsel

Ed Kunnes, Fidelity National Title, Attorney

Jeffrey S. Nelson, Fidelity National Title, Attorney

Richard M. McNeely, Fidelity National Title, Attorney

Nancy Van Tassel, Fidelity National Title, Vice President

Peter Wolff Jr., Fidelity National Law Group

William P. Foley II, Fidelity National Title Insurance Company, President and Chairman

“Somebody once said that in looking for people to hire, you

look for three qualities: integrity, intelligence, and energy. And if you don’t

have the first, the other two will kill you. You think about it; it’s true. If

you hire somebody without [integrity], you really want them to be dumb and

lazy.”

―Warren Buffett